If keeping your records in a shoebox was a good enough system three years ago, it’s clearly not enough at this point. Other businesses assign bookkeeping responsibilities to employees who lack the experience to follow through correctly. If you’ve been outsourcing your bookkeeping, it’s time to find a new accountant. If you’ve been keeping the books yourself or with in-house personnel, it’s time to get some extra training for the person who’ll be managing things from here on out. For now, you may well need to take control of the process yourself, at least for a little while.

Yearly Bookkeeping Checklist

By creating a system for ongoing bookkeeping maintenance, you’re setting yourself up for long-term success. It will help you stay organized, minimize future clean-up efforts, and ensure accurate financial reporting. Maintaining clean and accurate bookkeeping records is crucial for the success of any small business.

Stay up to date on the latest accounting tips and training

If you don’t have a budget, comparing your current income to previous months can be a good way to prepare for the future. Without a well-documented bookkeeping process, your firm may not be meeting its full potential in terms of profitability and growth. Staff may spend more time on each client, double checking which tasks are missing. This inefficiency has a knack for snowballing as your team members play catch-up with any missed assignments. Financial Cents offers a user-friendly interface for efficiently managing your firm’s bookkeeping workflow.

Partner with Acuity’s expert team and unleash stress-free bookkeeping today!

Let’s look at some tasks you can add to your monthly bookkeeping checklist that will ensure your firm is more profitable and ready for scalable growth. It ensures you stay organized, complete tasks on time, have accurate financial reports, and can effectively manage your clients’ finances. You can also use this checklist to train new staff to promote consistency and quality in your bookkeeping services. One of the most important items on your checklist is staying on top of deadlines.

Task Dependencies

Get in touch today, and consider it an investment in your future success. Organize all of your receipts and invoices so that they’re easily accessible. We recommend using a cloud-based accounting software to safely store your financial documents.

– Save $500 per month

In this article, we present a comprehensive step-by-step bookkeeping clean up checklist to help you regain control of your financial records. Adjusting entries are key for making sure you record transactions in the right accounting period. Again, you must make them after finding data entry errors and reconciling your books. Adjusting entries can be a little more technical than what most small business owners should be expected to do.

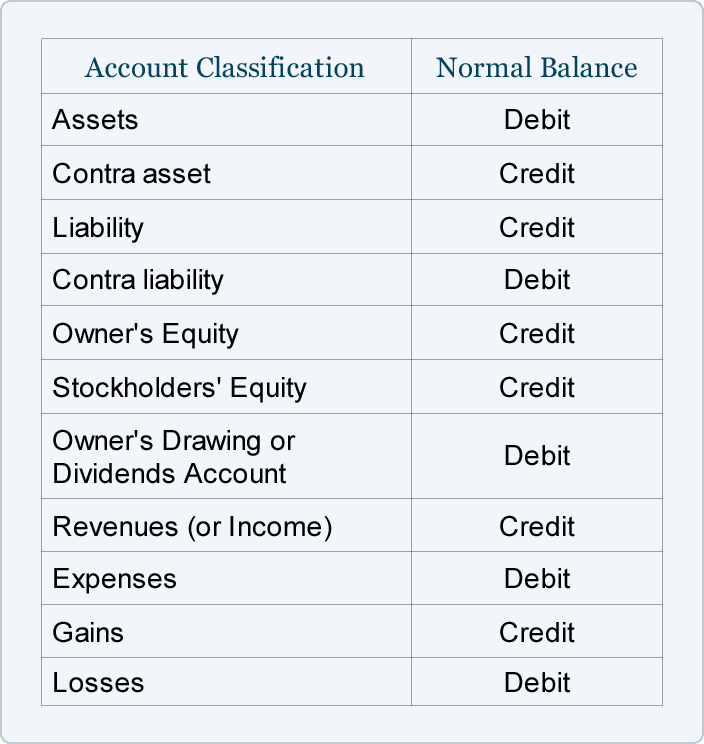

It is far more important that one person at the company be responsible for receiving and distributing all source documents related to your finances. The routine bookkeeping procedure consists of several processes, and in order to have a clean book, you must adhere to them each month. In this article, we’ll walk you through the steps of cleaning up bookkeeping, passive v non passive income explain why it’s crucial, and show you how to clean up accounting books to optimize your accounting procedure. The accounts used in your accounting software, such as assets, liabilities, revenues, and expenses, are listed in your chart of accounts. Your chart of accounts will be more logically ordered and understandable if you clean it up.

Ask your vendor to fill that order and send an invoice for the purchase order so you can move the money from your asset account into COGS (Cost of Goods Sold). Suppose your small business is located in any of the 45 states that collect statewide sales tax or in the District of Columbia. To initiate the process, begin by sorting through your email, which serves as a convenient storage system for managing electronic purchases. You can employ filters based on dates or keywords to facilitate your search.

Reconciling your accounts is the process of comparing what you record in your accounting books to what appears on your bank or credit card statement. This information is essential for managing your cash flow and ensuring that your business is running smoothly. By proactively reviewing accounts receivable regularly, you can quickly identify https://www.quickbooks-payroll.org/overpayment-of-benefits/ discrepancies or issues that need to be addressed. You can manage your finances more effectively and avoid problems arising down the road. A bookkeeper’s job is to keep track of all the money that flows in and out of your clients’ accounts. This helps your clients know how much money they have to work with at any given time.

- Below we offer a bookkeeping cleanup checklist for startups and small business owners that aren’t sure where to begin.

- Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting.

- Tracking your clients’ cash position means knowing how much money their company has on hand at any given time and making sure expenses get paid on time.

- Once you’ve done the bedrock work of reconciling your cash accounts, you can move on to other issues affecting your books.

- Download this checklist from Acuity, and start optimizing your financials.

If you don’t reconcile your books with your external account balances (e.g., bank account), you’re going to be left with bad books. To fix bad books due to errors of omission, comb through your records (e.g., receipts). Once you’ve reviewed, paid, and recorded both customer and vendor invoice payments, you are ready to check your credit card accounts and bank statements for accuracy. Bookkeeping is a day-to-day process of recording, classifying, and organizing a business’ financial transactions into a detailed “book” of record. Find and remove duplicates to get rid of unnecessary clutter and save your books from inaccuracies. Try to aim for reconciling your accounts each month for tidy books.

Making daily deposits is a crucial part of the bookkeeping process because it ensures that all money is accounted for, preventing any confusion over where it came from or went. Many bookkeeping tasks follow weekly, monthly, or quarterly accounting cycles. However, if you’re a full-charge bookkeeper or your clients have a large number of transactions, there are several tasks you should complete each day. By utilizing these tools and resources, you’ll be able to streamline your bookkeeping clean-up efforts, save time, and ensure accuracy in your financial records. Compare each transaction on your bank statement with the corresponding entry in your bookkeeping records. Look for any discrepancies, such as missing, duplicate, or incorrectly recorded transactions.

See how much time and money Karbon’s client portal can save your firm with this time savings calculator. This allows you to focus more on client-facing tasks while preventing any human error that may have contributed to messy books in the first place. Setting and communicating clearly defined expectations with your client will ensure all stakeholders know what to expect.

Payroll, if applicable, will need to be run at least once a month. Missing just one deadline can create a ripple effect,throwing off your entire system. That’s why you must be aware of upcoming deadlines and plan accordingly to keep your clients’ finances in order.

The sum of money your company owes to suppliers or vendors is called accounts payable. Start by collecting all your receipts, invoices, bank statements, and other financial documents. Sort them chronologically or by category, depending on your preference. So, let’s dive into the step-by-step https://www.adprun.net/ and get your small business finances back on track. You can find these types of errors by double-checking your work and preparing trial balances at the end of each reporting period.

Make a note of any transactions that you don’t have a record of and prepare to track down that information if needed. If you use a third-party payment processor, review all of your transactions there as well. You are looking to gather all of your bank statements, receipts, invoice, and other related financial information. In this article, you’ll find a best practice bookkeeping checklist template, plus a checklist for emergency bookkeeping cleanup projects. The best way I’ve found to stay organized is to follow a system and use a cleanup checklist customized for my different types of clients. Once you’ve done the bedrock work of reconciling your cash accounts, you can move on to other issues affecting your books.